Perth’s housing market outperforms national

In August, residential property values throughout Australia rose by 0.5%. Perth has maintained its position as the strongest-performing capital city in the nation for the 11th month in a row, rising by 2.0%. This was followed by Adelaide and Brisbane, which rose 1.4% and 1.1% respectively. In contrast, Canberra (-0.4%) and Melbourne (-0.2%) recorded the greatest contractions. (CoreLogic, 2024)

Dwelling prices in Perth have increased over the past quarter by 5.7%, marking a 24.4% rise over the past year; the highest in the nation (CoreLogic, 2024).

Perth’s property listings remain low

According to REIWA, there were only 3,637 properties listed for sale in the week ending 1 September 2024. This figure is up from the 3,266 recorded four weeks prior but down from the 5,131 in the same week last year.

The average time to sell a house in the Perth market remained at 9 days in August 2024, 1 day faster than 12 months ago. The average time to sell a unit also remained unchanged at 9 days (REIWA, 2024).

The graph below demonstrates the downward trend of stock availability within the Perth market to the week ending 1 September 2024.

Source: REIWA and Momentum Wealth Research

Rental prices remain stable

Perth’s median rental dwelling price remained stable at $650 per week in August 2024, which represents a 12.1% increase from 12 months ago. The median rental prices for houses also held steady at $650 per week, while units fell to $600 per week. (REIWA, 2024)

In recent months, rental prices have stayed relatively steady, indicating that the rental market may be hitting an affordability limit. Many renters are now looking for alternative leasing solutions, such as shared accommodations or lower cost units, as they struggle to manage the constantly increasing rental expenses.

There were 2,191 properties listed for rent in Perth during the week ending 1 September 2024, which is down from the 2,518 recorded four weeks prior and up from the 1,655 recorded the same time last year. (REIWA, 2024)

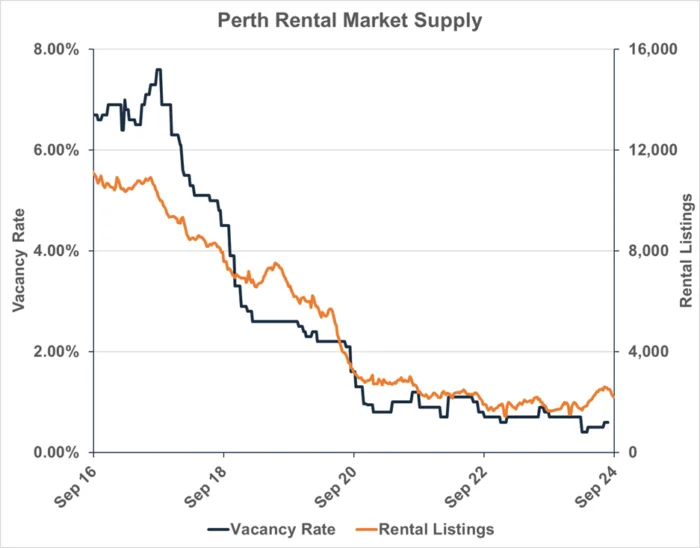

The graph below shows the recent uplift in the number of homes available for rent in the Perth market to the week ending 1 September 2024.

Source: REIWA and Momentum Wealth Research

During August 2024, it took a median of 19 days to lease a property, which is 1 day slower than the month prior and 4 days slower than 12 months ago. (REIWA, 2024)

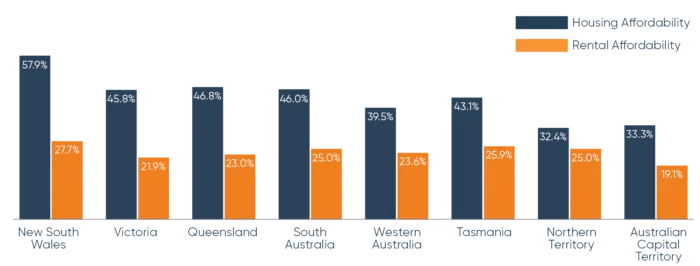

Despite Australia’s declining housing affordability, Perth remains more accessible

According to the Real Estate Institute of Australia (REIA), housing affordability within Australia is currently at its lowest level since REIA started monitoring this data in 1996. During the June 2024 quarter, the proportion of income required to meet the average loan repayment nationally rose by 1.3% to 48.1%.

In Western Australia, while housing saw a slight decrease with the average family now contributing 39.5% of their income towards mortgage repayments, up from the 37.8% recorded in the previous quarter, the state remains one of the most affordable regions in the country, alongside the Northern Territory and Australian Capital Territory.

New South Wales remains the least affordable state, where homeowners allocate 57.9% of their household income to mortgage repayments. This is up from the 56.3% recorded in the previous quarter as house prices continue to rise. Victoria, Northern Territory and the Australian Capital Territory were the only states to see a slight improvement in affordability. (REIA, 2024)

Source: REIA